Sunday, October 31, 2010

Lessons I learned from Trader Mike

One such trader was Trader Mike who has an excellent blog. It used to be a daily routine to visit his site, where I learned quite a bit about trading, Psychology, other traders (like Maoxian), keeping good records, self-analysis and keeping things simple. I also learned that many successful traders (if not all) follow quite similar paths of mistakes, experience and eventual success. One of my favorite posts is How I Became Such a Great Trader where he shares some valuable insight on his past experiences and some of the things he does to stay sharp.

Another lesson I learned is that while it is critical to focus on the technical and physical aspects of trading (trading plan, setups, charts, etc.), it is also very important to focus on the emotional aspects such as Psychology and self-affirmations. Now what's that you may ask? Trader Mike was not shy to share that he listens to a trade affirmations CD to make sure his mind stays 'right'. After purchasing the CD and listening to it, I understood why. I have converted the CD to MP3 and I listen to it as often as I can (on my iPod or PC). Here is a clip below:

Saturday, October 30, 2010

Some golden nuggets of advice from Dr. Elder on Psychology

However, in addition to reading his books, I also have Trading For a Living on CD and I make an effort to listen to it as often as I can. He emphasizes a lot on psychology of trading, as do many experts like Mark Douglass in Trading in the Zone (another must read).

Below is a clip from Dr. Elder’s book on Individual Psychology. In it, he offers some excellent advice for the average trader and some common mistakes that traders make (over and over again).

Some of my favorite quotes are along the following lines: The goal of a good trader is to NOT make money - it is to trade well. Money follows... Just because you have a successful system does not mean you will make money...

Sunday, October 24, 2010

Favorite setups from ST50 for week of 10/24

I hope everyone is having a great weekend. As usual, there were some fantastic and endless ideas and analysis on Stocktwits this weekend.

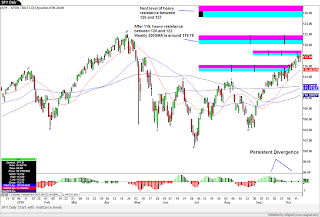

Let’s start by taking a look at the weekly and daily charts of the SPY:

Price action is right at the weekly 200MA of around 119, and the resistance areas on the daily can clearly be seen on the chart as well. The persistent trend keeps grinding higher in the face of some overbought conditions, but as we all know, that does not necessarily mean we will not go higher.

Personally, I will be exercising some caution next week and will not hold any overnight positions should the indexes exhibit any signs of weakness. Regardless, there are still some great looking charts out there.

Please do you due diligence on the picks (such as earnings, news releases, etc.). The recommendations are only meant as idea generation and my own personal analysis on these stocks. Additionally, please use proper money management should you decide to get into any positions. This are my weekly picks from the Stocktwits50 list:

APKT, UNP, INFA, CGNX, TIBX, INTU, CMG. Entry points and commentary on the charts below:

Good trading and good luck next week.

CL Analysis for coming week

Good morning – I hope everyone is enjoying their weekend.

Since I’ve been trading the crude oil futures a lot more these days, I wanted to share my thoughts on the longer term charts and some scenarios on how it might trade next week I will start with the Daily chart:

The daily shows a very obvious tight range/consolidation since early October between 79-84. The bounce off 38% Fib retracement shown on the chart is bullish and sets up a bull flag scenario with prices approaching 84-86, and eventual resistance in the 90-92 area.

Should it fail to breakout higher from this range, I would look for the 50% and 61.8% Fib levels to be tested, and if these do not hold, I would look for support in the 67-69 range.

Now, let’s look at the hourly chart below:

The tight range channel can be clearly seen here as well and the unexpected move late on Friday afternoon (on volume, I might add), brought the price right back to the top of the channel.

I believe this sets up a move above this channel and back to the 84 area in the very short term, but it all depends on the reaction of the markets to the G20 meetings this weekend. Where it goes and how it reacts at the 84-85 level will determine the outlook for the next few weeks.

In any case, as I have written many times on this site, I am not in the business of predicting where prices will go on Monday or Wednesday next week or any time in the future. I merely follow price action, understand where my support and resistance areas are, and take the high probability (and lower risk) trades. Analyzing the chart setup helps me plan my actions and my trades during the week. But I will not hesitate to change my bias at any given time should the chart show any significant changes.

I hope this helps.

Good luck and good trading next week

Friday, October 22, 2010

Anatomy of an Intraday Chart of CL (Revisited)

I wanted to follow up on the post from this morning regarding CL December futures 5 min intraday chart. Below is an updated end-of-day chart:

Points 1-6 were discussed in the previous post. However, on point 6, the support zone has moved since the chart was in an uptrend all afternoon.

7. 7a and 7b show the price touching the support area around 80.60 with the occurrence of a divergence on the MACD. A bounce from here would give very good odds for a long entry, which is exactly what happened.

8. Minor resistance area was taken out around 81.30.

9. Major resistance area was taken out around 81.60 and price continued to 82.10.

Strange action so late on a Friday afternoon for CL, but it is what is. All we can do perform the analysis and make real time decisions on what we see.

We’ll see what Monday morning brings.

Good trading.

Update on my ST50 picks this week

I want to start following up on my picks from the ST50 each week and report on their performance.

While many stocks on this list did extremely well, this is a way for me to record my results as well.

Here goes. These were my picks from the weekend:

CTSH : Setup was long over 66.80 (sorry, typo in the chart). Setup triggered yesterday and was good for at least $1.45 (2.2%)

AMZN : Did not trigger until today (post earnings and was a big winner), good for at least $5 (3%)

LXK : Triggered long at 46 on Wednesday and was good for about $1.30 (2.8%)

NBIX : 8.25 was triggered on Tuesday and was good for about 40c (4.8%)

MIPS - probably my favorite setup: Triggered at 10 on Monday and was good for around 50c (5%)

All in all – not bad at all. But then again the market has been unstoppable. Hope some of you caught some of these moves.

I’ll post some more charts over the weekend.

Have a great weekend.

Anatomy of an Intraday Chart of CL

Good morning.

I wanted to post and analyze a 5 minute chart of the CL Crude December futures. Earlier, I talked about rising trendline, breakout, false breakout, etc. and wanted to share what exactly I was looking at. Below is a 5 minute chart of CL:

There are 6 areas I’d like to focus on:

- This is a horizontal trendline at 81.60, which also coincided with a major resistance area. Usually at 9AM EST, there is a heavy move in one direction, and the thought process was if it breaks this level on some volume, it would breakout. Which it did.

- After the breakout, the next candle formed a Doji right on minor resistance at around 81.75. At that point, some profit was taken and stops moved to breakeven. Subsequently, the next candle dropped the price right back below 81.50 and the initial breakout/resistance area, signaling a false breakout.

- Shows the rising trendline Tweeted about, going back from around 3AM EST. As soon as it closed below it after 9:30AM, it moved lower to the first support area of around 80.90-81, where it has bounced briefly.

- Shows the are of minor support at 80.90-81.00.

- Shows the next area of support at 80.50-80.60.

- Shows the next area of support at 79.35-79.50. This area is a major magnet should CL decide to break below 80.50.

I hope this was educational. Whatever indicators you use in your trading, on whatever timeframe, introducing and using trendlines and support/resistance zones will greatly enhance your trading, not to mention money management techniques (knowing where take profits, etc.).

Please do not hesitate to drop me a comment or tweet if you have any questions.

Good trading.

Thursday, October 21, 2010

Trading radar for Oct 21

NFLX - the juggernaut, continues on a tear. So, far earnings this week have been well received. The selloff on Tuesday appears to be an aberration as it was almost fully recovered yesterday. This puts us back in up trend mode.

Futures are higher this morning but appear to be selling off a little bit, so we'll see what happens.

The following stocks are on my radar today:

Long:

ISLN

EBAY

ALXN

JBLU (or any of the airlines)

Short:

CRUS

PLCE

FITB

CY

CL recovery yesterday puts us back in the range of 80-84 that we've been stuck in since early October. A break of this range either way will provide for a powerful move IMO.

I am looking for short opportunities in CL, 6E and GC today.

Good luck and good trading!

Sunday, October 17, 2010

My favorite setups from the ST50 list for next week

Well, it was certainly quite an impressive week with some phenomenal action in individual stocks. Momentum names were up big, financials took a beating, and solars sold off hard on Friday to give up the entire week's gains.

I still believe there are some warning signs of a a correction - but it has not materialized into actual weakness in the indexes. On the contrary, the markets held up extremely well in the face of a selloff in Financials and some semis including Intel.

Looking at the chart of the SPY, there are some major challenges ahead. Some strong resistance areas are coming up in the 120-122 area. The election is coming around soon, and the majority of earnings will be released the next couple weeks.

It is clear that there are some major hurdles to keep this rally going. It would appear a lot of good news has already been priced in. But how much good news? This market has managed to surprise and just like the Energizer bunny, it just keeps on going.

The following are stocks that I will keep on my watchlist from the Stocktwits50 list:

CTSH

AMZN

LXK

NBIX

MIPS - probably my favorite setup

Don't forget to keep an open mind and not be 'married' to a position or an opinion. Things change on a dime and we must be prepared to adapt appropriately.

Good luck and good trading!

Thursday, October 14, 2010

Trading radar for Oct 14

With OpEx tomorrow, and the SPY at dizzying levels, not looking to do a whole lot the next couple days. Smaller size, quick profits and not holding anything for an extended period of time.

The following stocks are on my radar today:

ZAGG

RVBD

ARUN

ARMH

APOL (Or any education stocks with good short setups)

AMED

I'll also be looking for short opportunities in EUR, CL and GC.

Have a great day and good trading.

Monday, October 11, 2010

Trading radar Oct 11

I hope everyone had a great and relaxing weekend. I am delighted the Detroit Lions got their first win (of many I hope), and they completely destroyed the Rams.

As usual, the ST stream was filled with fantastic trading ideas this weekend. If you are not tuning in, I highly suggest checking out the recommendations and charts - just awesome.

With the holiday and lack of economic news today, not sure we will have a very exciting session. The following stocks are on my radar today:

SOLF

ATPG

WCRX

ISLN

JAZZ

I'll update any stocks with good setups on twitter. Looking for short entries in CL, GC and EUR (6E).

Wednesday, October 6, 2010

Some notes on trading style

I might trade several instruments a day - EUR, GBP, CL, GC, TF and stocks. Overall, my strategy is to scalp 10-15 ticks at a time for 1 batch on the futures, and let the rest run. I trade in multiples of 2 contracts - minimum 2, and maximum 10. For stocks - it depends on the range and price of the stock, but the concept is similar. Depending on the market (trending, rangebound, counter-trend) - I am more selective with taking profits and may bail out at certain price levels. If a trade does not go my way after a few bars, I may bail out at break/even or small loss/profit.

Sometimes, I do not have time to post the prices that I am trading, or all my trades for that matter. The point is not to have other people go in at the same time and price as me. If any traders are using my calls to enter long/short the market - then I think it is a big mistake. You don't know what my plan is, or my strategy, or even my timeframe. You could be long based on hourly, and I could be short based on 1 minute, and we could both make money.

I use traders comments as confirmation of my signals - if some of my follows are short, and I get a signal to go short (which I will take regardless), then it is just that extra level of confidence. But if I am going long, and some of my strong follows are short, I am not going to switch just because they are - which actually happened today. I was long EUR and couple of excellent traders were short. I held and it ended up being a great winner.

Early last year, I wrote a post here on not blindly entering trades based on Stocktwits traders. The advice I gave back then still holds - even more so, as there many more traders now on ST, and some are truly fantastic follows. But unless you are paying for a subscription to some of these amazing traders, please use your own analysis and rules to enter and exit the market. Please make sure you have a trading plan. Not mine or anyone else on ST.

Good trading!

Monday, October 4, 2010

Trading radar Oct 4

Futures a little down this morning. I have a slight bearish bias right now on the S&P. I would not mind a little breather here going into earnings.

Below are stocks on my radar (in addition to the stocks I posted over the weekend):

LONG:

MSCC

ISLN

TTWO

SHORT:

X, MT, STLD (Or any Steel stocks with the worst looking charts)

ATHR

NVDA

AMED

MRVL

XRTX

I'll post any other setups I see during the day on StockTwits. Looking for long opportunities in CL, EUR and GC.

Good luck and good trading.

Sunday, October 3, 2010

Do you believe in Divergence?

Divergence is when price makes a new high, but action in MACD is not confirmed - i.e. the MACD makes a lower high than the previous price high.

In the daily chart of SPY, I have highlighted the previous divergences on the chart. New highs in price were not confirmed by new highs in MACD. This can be seen in Divergence 1 and Divergence 4 on the chart. Subsequently, the SPY broke down and we had quite a drop in both instances. On the other hand, when prices made new lows, MACD did not confirm with new lows as can be seen in Divergence 2 and 3. Subsequently, prices went up.

We have what I believe is another such a divergence on the SPY shown by Divergence 5 on the chart. Recent price highs (which happens to be on a strong resistance area by the way), are not being confirmed by a high in MACD. In fact, the MACD is not only declining, but looks ready to cross over below 0.

Now this does not mean that prices will drop for sure, we may just rest here for a while, or make even higher highs. But it does make one be a bit more cautious, even defensive. Raising a bit more cash is not a bad idea, especially with the run we've had in September.

Personally, I always like to have two watchlists to use at any time - a long and a short watchlist. But this week, I will pay extra attention to stocks that are ready to roll over, and I'll be more aggressive with the futures if I see that we are indeed breaking down to lower prices.Good luck and good trading!

Saturday, October 2, 2010

My favorite setups from ST50 for next week

While I like all the stocks in the Stocktwits 50 list, below are a few of my favorite setups - charts and descriptions on Chart.ly:

Will post some more charts later tonight and tomorrow.

Have a great weekend!

Friday, October 1, 2010

Trading radar Oct 1

I hope everyone had a great September - definitely a nice run. Yesterday, the markets had a 'failed breakout' and reversed hard after a strong open. Not sure if much emphasis can be placed on the action since it was end of month and end of quarter. Nevertheless, I am adding to my short watchlist and turning a it more bearish. Not bearish - the sky is falling bearish, more of a reasonable pullback before the highs are retested.

In any case, up or down, always ready to change my disposition on a dime based on the price action.

The following stocks are on my radar today:

GYMB

CCME

APWR

COGT

GMCR

WCRX

Also looking for pullbacks in CL, EUR and GBP.

Make it a great trading day and month!